Cryptocurrency is the New Oil : The Powerful Rise in Digital Currency

Rise in Digital Currency, crypto is the new oil, playing a pivotal role in the global economy as digital assets gain popularity. With a rapidly growing market and expanding use cases, cryptocurrency is becoming a sought-after alternative to traditional investments and financial transactions.

Table of Contents

As the digital revolution continues to reshape industries, many are looking to cryptocurrencies as a modern and innovative asset class. The decentralized nature of crypto and its potential to disrupt traditional financial systems has positioned it as a formidable contender in the global economy.

As businesses and individuals increasingly embrace digital currencies, the impact of crypto on global markets and trade is becoming more pronounced. In this era of digital transformation, the comparison of crypto to oil underscores its growing significance and influence on the modern economic landscape.

Credit: www.bankrate.com

Understanding Rise in Digital Currency and Crypto

Crypto, often referred to as the new oil, has emerged as a revolutionary asset. Its potential to reshape industries and economies is undeniable, making it crucial to understand the intricacies and opportunities it presents.

Understanding Crypto When it comes to understanding cryptocurrency, it’s essential to grasp the basics of digital currency and the evolution of crypto. The term “crypto” refers to cryptocurrencies, which are decentralized digital assets that use cryptography for secure financial transactions.

The Basics Of Digital Currency

Digital currency is a form of money that exists purely in electronic form. This currency operates independently of a central bank or government. It is stored and transacted electronically. Cryptocurrencies are a subset of digital currencies, and they leverage blockchain technology to enable secure and transparent transactions.

- Digital currency exists solely in electronic form

- Cryptocurrencies operate independently of central authorities

- Blockchain technology ensures secure and transparent transactions

The Evolution Of Crypto

The evolution of crypto can be traced back to the launch of Bitcoin in 2009. Initially, Bitcoin was seen as a novel experiment, but it soon gained traction as an alternative to traditional currencies. Since then, the crypto space has expanded exponentially, with the introduction of numerous other cryptocurrencies and the development of applications beyond currency, such as smart contracts and decentralized finance (DeFi).

https://www.youtube.com/watch?v=qgTS2caVjDE

- Bitcoin’s launch in 2009 marked the beginning of crypto

- Crypto has evolved to encompass various cryptocurrencies and applications

- Smart contracts and decentralized finance (DeFi) have expanded crypto’s potential

In conclusion, understanding the basics of digital currency and the evolution of crypto is crucial for comprehending the significance of crypto as the new oil.

The Rise Of Crypto

Cryptocurrency, often referred to as “crypto,” has emerged as a disruptive force in the financial world. Its rise has been likened to the impact of oil on the global economy in the 20th century. The growing popularity of cryptocurrency and its potential impact on traditional financial systems are heralding a new era in finance.

The Growing Popularity Of Cryptocurrency

In recent years, the interest and adoption of cryptocurrency have skyrocketed. Bitcoin, the pioneering cryptocurrency, has paved the way for a plethora of alternative digital currencies. These digital assets offer secure, decentralized, and borderless transactions, captivating a global audience. The advent of blockchain technology has enabled the creation of diverse cryptocurrencies with unique features, fostering a dynamic and evolving market.

Moreover, the rapid rise of decentralized finance (DeFi) applications has further propelled the popularity of cryptocurrency. DeFi platforms, built on blockchain technology, offer users opportunities to earn interest, trade assets, and access financial services without intermediaries. This democratization of finance has attracted a widespread demographic, fueling the growth of cryptocurrency ecosystems.

https://www.youtube.com/watch?v=qgTS2caVjDE

The Impact On Traditional Financial Systems

The burgeoning popularity of cryptocurrency has the potential to disrupt traditional financial systems. Centralized financial institutions are facing the challenge of redefining their roles in a landscape that embraces decentralized and trustless transactions. Cryptocurrency’s borderless nature transcends geopolitical boundaries, presenting a formidable challenge to the traditional banking infrastructure.

Furthermore, the integration of cryptocurrency into mainstream financial markets has prompted regulatory considerations. As governments and regulatory bodies navigate the complexities of digital assets’ widespread adoption, there is a paradigm shift in the traditional financial landscape. The impact of cryptocurrency on payment systems, monetary policies, and international trade is poised to redefine the financial ecosystem as we know it.

Credit: youtube.com

Crypto Vs Oil

Crypto has emerged as a formidable challenger to oil, positioning itself as the new commodity for investment. With its decentralized and digital nature, crypto offers potential for high returns and opportunities for diversification, making it an attractive alternative to traditional oil investment.

Comparing The Value And Influence

When it comes to comparing crypto and oil, both have immense value and influence in the global economy. However, they differ significantly in terms of their nature and the impact they have on various aspects of our lives.

Oil has long been considered the lifeblood of the global economy, powering industries and driving economic growth. With its high energy density and widespread usage, oil has maintained its position as a critical resource for decades. It influences various sectors, including transportation, manufacturing, and agriculture.

On the other hand, we have crypto, an emerging digital asset that has rapidly gained traction in recent years. While it cannot match oil’s tangible value, crypto has its own unique qualities that make it highly desirable. With its decentralized nature, blockchain technology, and growing acceptance, crypto has the potential to revolutionize the way we trade, invest, and transact.

The Shift Towards Digital Assets

In today’s digital age, we witness a significant shift towards digital assets, and crypto is at the forefront of this transition. Traditional assets like oil are limited by physical constraints, such as storage capacity and transportation limitations. As a result, they are prone to geopolitical tensions, price volatility, and environmental concerns.

https://www.youtube.com/watch?v=qgTS2caVjDE

Crypto, on the other hand, provides a viable alternative, with its digital nature eliminating many of the limitations faced by traditional assets. It offers borderless transactions, faster settlement times, and enhanced security, making it an attractive option for individuals and businesses alike.

Moreover, the rise of decentralized finance (DeFi) has further accelerated the adoption of crypto. DeFi platforms leverage blockchain technology to create a decentralized financial ecosystem, offering services like lending, borrowing, and yield farming. This innovation has the potential to disrupt traditional financial systems and democratize access to financial services.

In conclusion, while crypto and oil hold significant value and influence, their impact and potential are distinct and divergent. While oil has dominated the global economy for decades, the emergence of crypto and digital assets brings forth new possibilities and opportunities. As the world increasingly embraces digitalization, it is crucial to adapt and navigate the evolving landscape to make the most of these transformative technologies.

Credit: www.bankrate.com

The Power Of Crypto

One of the most talked-about topics in recent years is cryptocurrencies. Crypto, short for cryptocurrency, offers a whole new world of possibilities and benefits. In this blog post, we will explore the power of crypto and how it is transforming various industries. From the potential for high returns to the disruptive nature of blockchain technology, crypto is proving to be the new oil for the digital age.

The Potential For High Returns

When it comes to investing, everyone wants high returns. Crypto offers just that. With several cryptocurrencies experiencing astronomical growth in value, it is no surprise that many investors are flocking to this new asset class. Whether it’s Bitcoin, Ethereum, or any number of altcoins, the potential for high returns is undeniable.

The decentralized nature of cryptocurrencies, combined with their limited supply, creates scarcity and drives up prices. This scarcity, along with the market demand for these digital assets, has resulted in impressive returns for early adopters. In fact, some investors have seen their initial investments multiply several times over in a relatively short period.

However, it’s important to note that crypto investing comes with risks. The volatile nature of the cryptocurrency market means that prices can fluctuate wildly, and there is always the potential for losses. It’s crucial to do your own research, understand the risks involved, and only invest what you can afford to lose.

https://www.youtube.com/watch?v=qgTS2caVjDE

The Disruptive Nature Of Blockchain Technology

When discussing the power of crypto, it is impossible to ignore the underlying technology that drives it – blockchain. Blockchain technology is a decentralized ledger system that enables secure and transparent transactions. It eliminates the need for intermediaries, such as banks or governments, and allows for direct peer-to-peer transactions.

The disruptive potential of blockchain technology extends far beyond cryptocurrencies. It has the ability to revolutionize industries such as finance, supply chain management, healthcare, and more. By removing the need for intermediaries and providing immutable and transparent records, blockchain technology offers increased efficiency, security, and trust.

Financial institutions are already exploring the use of blockchain for cross-border payments and smart contracts. Supply chain management can benefit from the transparency and traceability provided by blockchain. Healthcare providers can securely store and share patient data while maintaining privacy.

As blockchain technology continues to evolve and mature, we can expect to see even greater disruption across various sectors. Crypto is not just about digital currencies; it signifies a paradigm shift in how we transact, collaborate, and trust.

Just a few short years ago, cryptocurrency was a little-known and often misunderstood concept. Today, digital currency has become a global phenomenon, with more and more people recognizing its potential as a powerful investment tool and a viable alternative to traditional currencies.

But what makes cryptocurrency so powerful, and why is it being hailed as the new oil? In this article, we’ll explore the parallels between cryptocurrency and oil, and examine the factors that have contributed to its rapid rise.

Cryptocurrency and Oil: A Comparison

At first glance, cryptocurrency and oil may seem like two very different things. However, there are several similarities between the two that make them a powerful force in the global economy.

- Scarcity: Like oil, cryptocurrency is a scarce resource. There is a limited supply of both, which helps to drive up their value over time.

- Global Reach: Both cryptocurrency and oil have a global reach, with users and buyers located all around the world.

- Volatility: Both cryptocurrency and oil are highly volatile, with prices that can fluctuate rapidly in response to market conditions.

- Innovation: Both cryptocurrency and oil have been at the forefront of innovation, with new technologies and uses being developed all the time.

Factors Contributing to the Rise of Cryptocurrency

There are several factors that have contributed to the rapid rise of cryptocurrency, including:

- Increased Adoption: More and more businesses and individuals are adopting cryptocurrency as a form of payment, driving up demand and pushing up prices.

- Improved Infrastructure: The infrastructure supporting cryptocurrency has improved significantly in recent years, making it easier for users to buy, sell, and store their digital assets.

- Regulatory Clarity: Regulators around the world are starting to provide clearer guidelines around the use of cryptocurrency, which has helped to reduce uncertainty and increase confidence in the market.

- Increased Media Attention: The increased media attention around cryptocurrency has helped to raise awareness and interest in the market, driving up demand and prices.

- Decentralization: Unlike traditional currencies, cryptocurrency is decentralized, meaning that it is not controlled by any single government or institution. This has helped to make it more resilient to market shocks and economic downturns.

Why Cryptocurrency is the New Oil

Cryptocurrency is being hailed as the new oil for several reasons:

- Powerful Investment Tool: Like oil, cryptocurrency is a powerful investment tool, with the potential for significant returns.

- Global Reach: Cryptocurrency has a global reach, making it a viable alternative to traditional currencies for international transactions.

- Innovation: Cryptocurrency is at the forefront of innovation, with new technologies and uses being developed all the time.

- Decentralization: Like oil, cryptocurrency is a decentralized resource, making it more resilient to market shocks and economic downturns.

Investing In Crypto

Investing in crypto is akin to tapping into the new oil. With the potential for high returns, cryptocurrencies are gaining traction as a lucrative investment opportunity. As traditional markets may fluctuate, crypto offers a diversification path and a chance to capitalize on an emerging asset class.

Understanding Risk And Volatility

When it comes to investing in cryptocurrency, it’s essential to understand the potential risks and volatility involved. Cryptocurrency markets are known for their price fluctuations, with values sometimes skyrocketing or plummeting within a short period. As with any investment, there is a level of risk involved. However, with proper knowledge and strategy, you can navigate these risks and potentially make profitable investments.

Strategies For Successful Crypto Investments

To maximize your chances of success in the crypto market, it’s crucial to adopt effective investment strategies. Here are a few strategies to consider:

1. Diversify your portfolio: Spread your investment across different cryptocurrencies to mitigate the risk associated with any one particular cryptocurrency. Diversification helps minimize the impact of market volatility on your overall investment.

2. Research and stay informed: Stay up-to-date with the latest news and developments in the cryptocurrency world. Conduct thorough research before investing in any cryptocurrency to make informed decisions.

3. Set clear investment goals: Define your investment objectives and the timeframe for achieving them. This will help you make decisions aligned with your financial goals and keep you focused on the long-term perspective.

4. Utilize dollar-cost averaging: Instead of investing a large sum of money all at once, consider investing smaller fixed amounts at regular intervals. This strategy allows you to average out the cost of your investment, reducing the impact of short-term price fluctuations.

5. Use stop-loss orders: Implementing stop-loss orders can help protect your investments by automatically selling a cryptocurrency if its price falls below a certain predetermined level. This prevents significant losses and gives you more control over your investment.

6. Stay prepared for market corrections: Cryptocurrency markets can undergo significant corrections after bullish runs. It’s important to be mentally prepared and not let short-term price movements drive your investment decisions.

https://www.youtube.com/watch?v=qgTS2caVjDE

7. Consider long-term hodling: If you believe in the long-term potential of a particular cryptocurrency, consider holding onto it for an extended period. This strategy allows you to ride out short-term market fluctuations and potentially benefit from future value appreciation. Investing in crypto can be a highly lucrative venture, but it’s crucial to approach it with a solid understanding of risk, and a well-defined investment strategy.

By adhering to these strategies and staying informed, you can navigate the crypto market with confidence and increase your chances of achieving successful investments. Remember, be patient, as the crypto market can be volatile, and always be prepared to adapt your strategies when necessary.

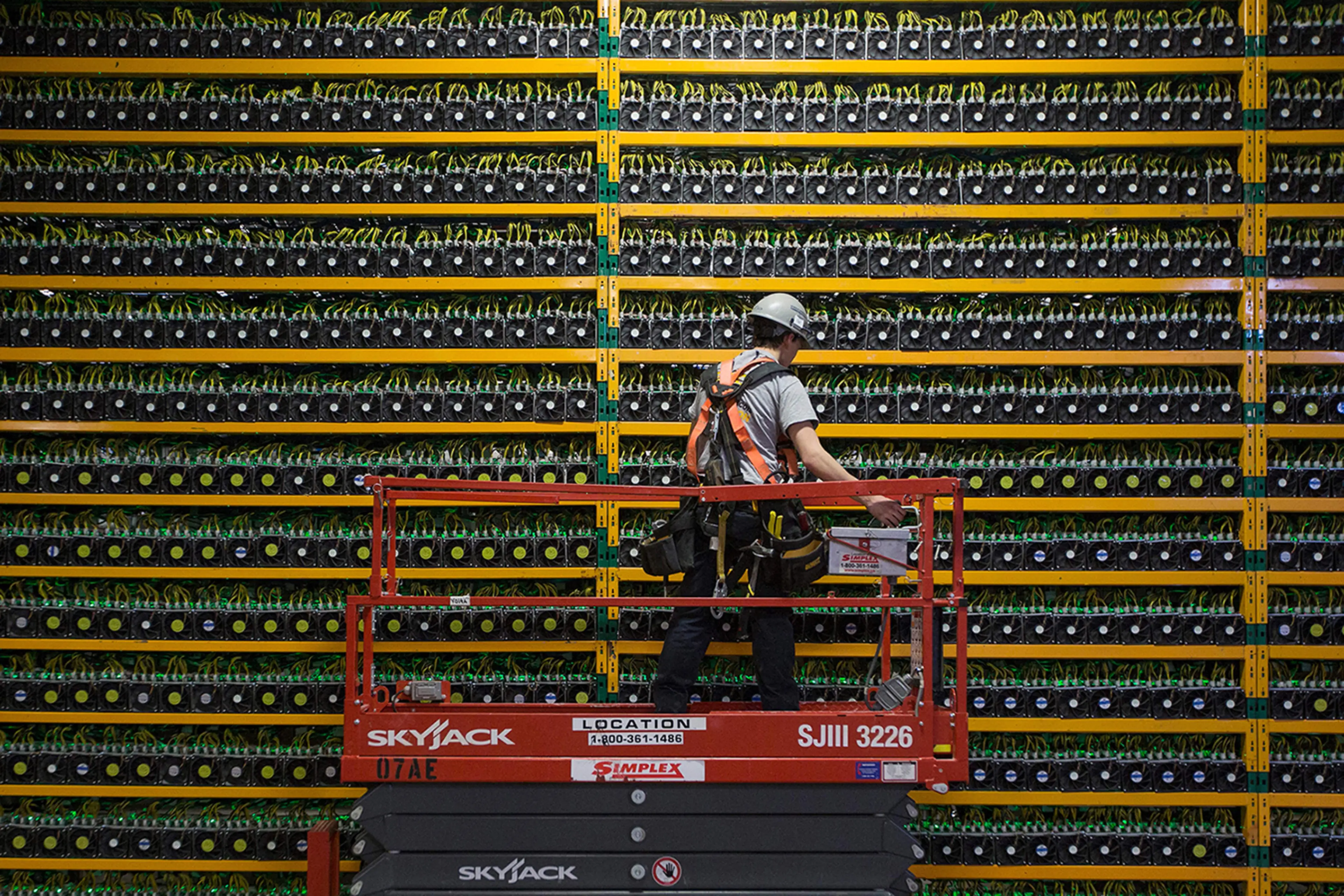

Credit: www.cfr.org

Frequently Asked Questions On Crypto Is The New Oil

Can Crypto Replace Traditional Currencies?

Yes, crypto has the potential to replace traditional currencies as it offers a decentralized and secure alternative. With features like immutability and transparency, crypto provides an efficient means of transaction without relying on centralized authority or intermediaries.

What Are The Advantages Of Investing In Crypto?

Investing in crypto offers several advantages including potential high returns, diversification, and easy access to global markets. Additionally, crypto investments provide opportunities for wealth creation, financial autonomy, and protection against inflation.

Is Crypto As Valuable As Oil?

Crypto, like oil, holds significant value due to its scarcity, utility, and demand. While oil is a finite resource used in various industries, crypto offers digital scarcity and serves as a decentralized medium of exchange. Both assets are vital for economic growth and have their respective importance.

Conclusion

Cryptocurrency has risen to prominence, emerging as the new oil of the digital era. Its potential for growth and financial independence is unparalleled. With its decentralized nature and the ability to disrupt traditional systems, crypto has the power to reshape the global economy.

As more individuals and institutions embrace this transformative technology, the future of cryptocurrency looks promising. It’s time to recognize and harness the power of crypto as the fuel for a new era of financial freedom.